Value added tax calculation

12 Dividing the taxes by the value and multiplying by 100 to convert to a rate per 100 of value produces the no-new-revenue tax rate. Net increase in inventory stocks is involved in national income calculation as a part of capital formation.

Wacc Formula Cost Of Capital Financial Management Charts And Graphs

B the appraised value of the property for the preceding tax year.

. As taxable income increases income is taxed over more tax brackets. Value Added Tax or VAT is a tax on the consumption or use of goods and services. Product or value added method is a way of computing the national income of a country.

Repealed by Act No. Main Division Value Added Tax Legal Division Schwarztorstrasse 50 3003 Berne. When tax due and payable.

This is a tax applied on the value added to goods and services at each stage in the production and distribution chain. Value-added tax 67A Application of increased or reduced tax rate. Value-Added Tax - VAT.

VAT stands for Value Added Tax. Economic Value Added EVA shows that real value creation occurs when projects earn rates of return above their cost of capital and this increases value for shareholders. And C the market value of all new improvements to the property.

8- Calculation of PROTAX-KSA payable. File and Pay. Why pay VAT when sales tax is already being levied by government.

In the example shown the tax brackets and rates are for single filers in the United States for the 2019 tax year. PART 4 TAX ON SUPPLY DIVISION 1THE TAX 14. Value Added Tax Vat In Saudi Arabia governments the new law that the VAT rate was increased by the government 5 is the old rate 15 8775 Prince Abdulaziz Bin Musaid Bin Jalawi Al-Sulaimaniyah Dist Unit Number.

The amount of income that falls into a given bracket is taxed at the corresponding rate for that bracket. If you have 1000 in the bank today then the present value is 1000. The remaining amount ie 150 will be paid to the government.

A change is only possible at the beginning of a new tax period. A VAT of 5 per cent is levied at the point of sale. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

Assessable Value CIF Value Calculation- Here I explained a new method to calculate the assessable value and CIF value to find import customs duty. VAT and sales tax have different purposes and hence are kept separate. To report the calculation of the amount of tax both for reporting Pajak Pertambahan Nilai PPN VAT and luxury sales tax PPnBM payable SPT Masa VAT is a form that is used by corporate taxpayers.

45A Calculation of interest payable under this Act S. Many taxpayers therefore pay several different rates. B When appraising a residence homestead the chief appraiser shall.

The cost of interest is included in the finance charge WACCcapital that is deducted from NOPAT in the EVA calculation and can be approached in two ways. Value-Added Tax VAT Information on how to register for calculate pay and reclaim VAT VAT rates and VAT on property rules. In corporate finance as part of fundamental analysis economic value added is an estimate of a firms economic profit or the value created in excess of the required return of the companys shareholdersEVA is the net profit less the capital charge for raising the firms capital.

EU VAT frequently asked questions. For instance if the cost of a product is 1500 and the percentage at which VAT is charged is 10. 4 Economic Value Added EVA Calculation.

Economic Value Added EVA for the year 2016 Net Operating Profit After Tax Capital Invested WACC 70000 2559 67441. It is charged at rate of 0 9 and 15. 13 See Tax Rate Calculation Example 1 PDF.

A value-added tax VAT is a type of consumption tax that is placed on a product whenever value is added at a stage of production and at the point of retail sale. For the correct VAT treatment it is necessary to determine which of the supplies should be considered as movable ie. Want Amazon to handle VAT.

5 of Act 61 of 1993 PART VII REPRESENTATIVE VENDORS 46 Persons acting in a representative capacity 47 Power to appoint agent. Only certain taxpayers are eligible. The freight and insurance costs are to be added.

Problems of Double Counting. Adjusted Present Value - APV. Situations covered assuming no added tax complexity.

If you have a simple tax return you can file with TurboTax Free Edition TurboTax Live Basic or TurboTax Live Full Service Basic. The idea is that value is created when the return on the firms economic capital employed exceeds the. The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any financing benefits.

Value Added Tax payable 10 x IDR 25000000 IDR 2500000. Learn how to register for VAT value added tax and how to file VAT returns in the UAE. If you kept that same 1000 in your wallet earning no interest then the future value would decline at the rate of inflation making 1000 in the future worth less than 1000 today.

List of VAT Registered Tax payer as at 9th June 2022 NEW. While sales tax calculation is an easy process VAT is a multi-level process and a more complex form of taxSales tax is simply calculated as a percentage of the final selling price of goods and services and is levied from customers at the. The exact calculation be made as per the provisions contained in the relevant Acts and Laws.

PART 3 TAX ON IMPORTS 9. The present value is simply the value of your money today. Comptroller to collect tax.

What is Value Added Tax VAT. Value Added Tax VAT is a tax on spending that is levied on the supply of goods and services in Fiji. Insurance is calculated as 1125 Rs1125.

1 appraise the property at its market value. From the above we have all three factors ready for Economic Value Added calculation for 2016 and 2015. The consumer will pay 1650.

Calculating the no-new-revenue tax rate requires the prior years taxes and the current years taxable value for property taxed in both years. The VAT Act requires most businesses and organisations involved in taxable activities in Fiji to. VAT Standard Rate 125 NHIL 25.

45A inserted by s. Value of imported goods. The exchange rate chosen by the taxpayer has to be kept for at least one tax period and has to be used for the calculation of the domestic tax the reverse charge and the input tax.

IGST Integrated Goods. Its a tax that VAT-registered traders in Europe add to the price of the goods they sell and pass on to the national tax authorities when they file their tax returns. For supplies within the EU this supply can be considered as a VAT.

For cross-border chain transactions VAT registration of some transaction parties in the EU Member State of taxation could be necessary. 20 of the FOB value is taken as freight. The merchant in this case will keep 1500.

A 10 percent of the appraised value of the property for the preceding tax year. 54 Riyadh 12234 2949 Kingdom of Saudi Arabia. Values added include tax interest wages profit.

This system is also known as output or inventory method. Value-added tax is charged as a percentage of the total cost of a product. Refund on overpayments of tax on imports.

Learn more about VAT Services. Businesses collect and account for the tax on behalf of the government. IMPOSITION OF THE TAX 6.

Simple Interest Vs Compound Interest Top 8 Differences To Learn Simple Interest Compound Interest Maths Solutions

Revised Gst Rate Slab On Jewellery Gstinsight Gstindiaexpert Goods And Service Tax Goods And Services Accounting And Finance

Value Added Tax Vat Infographic Value Added Tax Ads Tax

Value Added Tax Explained What Is Vat And How To Calculate It Place Card Holders Value Added Tax Add Tax

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

Differentiate Between Vat And Sales Tax In 2022 Sales Tax Differentiation Tax

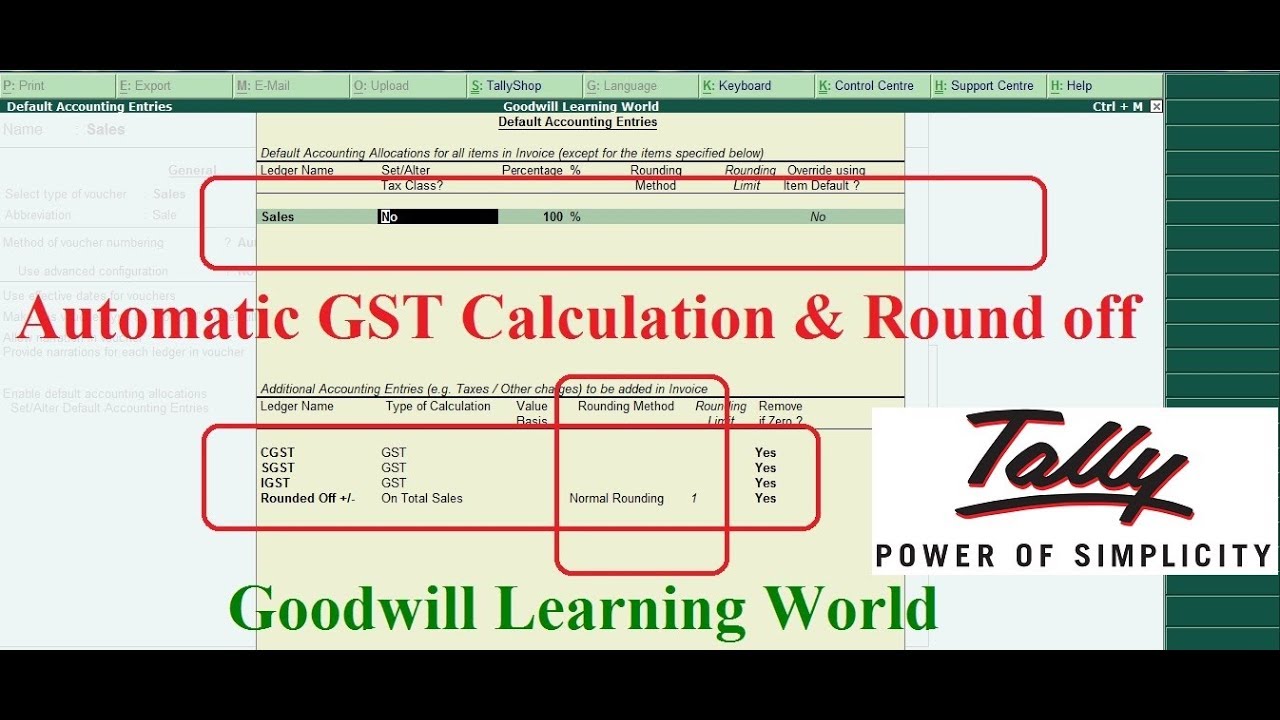

Tally Advance Configuration Auto Round Off And Auto Gst Calculation In Tally

Pin On Airbnb

Download Revenue Per Employee Calculator Excel Template Exceldatapro Excel Shortcuts Metric Excel Templates

Vat Registration Threshold Calculation In Uae Vat Consultants In Dubai Uae Tax Debt Indirect Tax Seo

How To Calculate Vat In The Kingdom Of Saudi Arabia Vat In Uae Goods And Services Registration

Automatic Tax Calculation Tax Creative Professional Accounting

Pin By Rajesh Doye On Gst India Goods And Services Tax General Knowledge Book Government Lessons Accounting And Finance

Calculation Of Late Form Gstr 3b Return Filing Fees On Gst Portal Gst Portal Will Now Be Calculating Late Fee Cgst Portal Latest Form Goods And Service Tax

Download Saudi Vat Payable Calculator Excel Template Exceldatapro Excel Templates Templates Calculator

Accounting Services In Dubai And Audit Services In Dubai Accounting Services Audit Services Accounting Firms

Vat Vs Gst Infographic Simple Flow Chart Infographic Goods And Services